Content

- Incorrect Accounts Payable or Receivable Reports

- Review Tax Filings

- Review loose ends

- Executing the Clean-Up Process – A Bookkeeper’s Guide for Doing a “Clean-Up” on Records

- #6 Have a Tax Plan in Place

- Understanding the Client’s Business and Industry – Preparing for the Clean-Up

- What are some common bookkeeping errors that can impact my business taxes?

- A Bookkeeper’s Guide for Doing a “Clean-Up” on Records – Tackling Clients’ Messy Books

From there, they’re on an ongoing bookkeeping cadence that best suits their needs. Moreover, accounting software often provides data import and export capabilities, allowing you to transfer cleaned-up bookkeeping clean up data between different accounting periods or platforms seamlessly. You can also develop templates for common journal entries, such as correcting Undeposited Funds or adjusting account balances.

For businesses with many 1099s, we offer 1099 preparation services to fit your business needs and budget. If you’re unable to send out a 1099 to the contractor and IRS, you will be at risk of fines and penalties for non-compliance. The Transaction review tab shows transactions with missing or incorrect info.

Incorrect Accounts Payable or Receivable Reports

There’s that credit card charge from back in March that is still uncategorized, and you haven’t taken the time to figure out what it was. Your bookkeeping clean up will be done by an experienced bookkeeper here in the US. We’ll go through each item and accurately sort out your financial records. Cleaning up QuickBooks data is a very time-consuming task, however, it is not a one-time job. Your startup required a full-time finance and bookkeeping functioning team that can support you to uphold GAAP rules and prepare a chart of accounts that helps you address long-term goals.

What are the 7 steps in the accounting cycle?

- Identifying and Analysing Business Transactions.

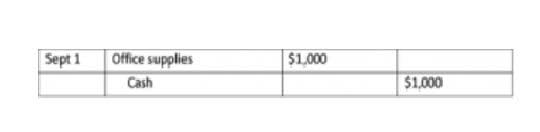

- Posting Transactions in Journals.

- Posting from Journal to Ledger.

- Recording adjusting entries.

- Preparing the adjusted trial balance.

- Preparing financial statements.

- Post-Closing Trial Balance.

Our platform also offers user-friendly access to comparative data over your business’s operational lifespan, providing essential information about long-term growth. In other words, you shouldn’t expect a contract bookkeeper to clean up your books in five to 10 hours. To keep the project within a timely manner (and avoid future accounting issues), work with a team with experience in your industry year around. If you’re looking for a bookkeeping checklist, you’ve probably identified a problem with your current strategy. By setting goals and acknowledging known issues with your bookkeeping practices, you’ll be able to determine an appropriate course of action going forward.

Review Tax Filings

You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop. Schedule a free consultation with our team to get an individualized quote at the best price for your business. Get your free Financial Health Score today, and join hundreds of entrepreneurs who are on track to healthier books. You’ll come away with an actionable score (from 0% to 100% correct) and a detailed report of what’s working and what needs fixing to get your books clean. For example, a bookkeeper might offer a flat fee of $1,500 for a Clean-Up, regardless of whether it takes 15 or 30 hours to complete. This approach enables you to resolve similar issues cohesively, accelerating the Clean-Up process.

- If your bookkeeping client has months or years worth of messy, mistake-ridden QuickBooks transactions, how do you even begin to fix that?

- Breaking down the tasks into smaller, manageable chunks helps track progress and maintain momentum.

- If you find yourself dealing with any of the above issues, it might be time to give your books some TLC.

- It is addressed to small business owners, but the advice found here can help anyone faced with poorly maintained financial records, including independent bookkeepers.

- Next, contact any vendors or clients you have done business with over the past year.

Have you properly recorded all fixed assets you purchased last year? Have you capitalized what should be capitalized and expensed what be expensed? You may leave this to your tax accountant and use tax depreciation as your book depreciation, which is normally fine. If your bookkeeping client has months or years worth of messy, mistake-ridden QuickBooks transactions, how do you even begin to fix that? I talk about where to start, what to charge as a bookkeeper, what documents you need, how long will a clean-up take, and some of my personal experiences and opinions about bookkeeper clean-ups.

Review loose ends

Significant prior-year errors may affect your previous tax returns and financial statements. As an example, missed sales or expenses can change your taxable income. Errors could result in additional tax you should have paid or more of a refund.

After locating the source of your problems, you’ll probably be tempted to jump right in and begin fixing them. It’s wiser, though, to take a breath at this point and ensure that your books suffer no further damage. The key to this step is making sure that all incoming documents are handled by a reliable accounting system under the eye of a reliable bookkeeper. Too often, small business owners continue to manage the books themselves, even after the business has grown and its accounting needs have changed. If keeping your records in a shoebox was a good enough system three years ago, it’s clearly not enough at this point. Other businesses assign bookkeeping responsibilities to employees who lack the experience to follow through correctly.

Executing the Clean-Up Process – A Bookkeeper’s Guide for Doing a “Clean-Up” on Records

Software like QuickBooks Online will automatically reconcile accounts if you’ve given the software access to automatic feeds. However, the reconciliation should still be reviewed for accuracy and compared to bank statements. If you are working with a physical https://www.bookstime.com/ file, make sure you have all of the information from the business owner that you need before you begin the process. By cleaning up your books, you’ll be better prepared for tax season, and you won’t be left paying a hefty fee for data clean-up work.

- Cloud-based accounting apps can automate repetitive tasks, such as expense reporting, payroll taxes, and data entry.

- Consistently assessing your accounts payable (AP) and accounts receivable (AR) is key to keeping your business running smoothly.

- Reports can be pulled quickly from your cloud-based accounting system.

- Taking steps to clean up accounting records can be a big undertaking for small business owners.

This should be a quicker process, in part because there ought to be a close relationship between the payments you have made on your credit lines and your newly reconciled bank records. Be sure to record any interest paid on lines of credit as an expense, and keep an eye out for especially unusual activity, such as negative balances. As with your cash accounts, plan to reconcile each credit account once a month going forward. If your books have been in disarray for years upon years, you might be tempted to draw the line and stop the reconstruction process. It’s vital that you clean up the last three years of records, and best if you go back seven years. Beyond that, you might not get much practical value from the exercise, and it’s unlikely that anyone else will ask you to go back any farther.